Post-Pandemic Times – Sand Hill Moves to Middle America

Tech Sector’s Growth has Accelerated

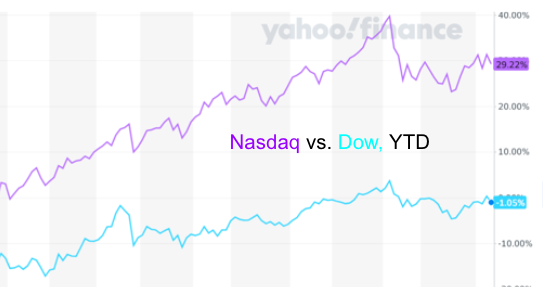

It is no secret that during the pandemic, the tech sector is delivering stronger returns than other sectors.

As examples, underlying the stock prices, Zoom sessions increased from 10M daily in Dec 2019 to 200M daily in March 2020. Daily broadband usage in the US jumped from 13.2GB in March 2020 to 15.3GB in August 2020. Over the 10 years from 2009-19, US e-commerce penetration went from from 5.6 to 27%. E-Books have been flying off e-library shelves. Doctors are seeing patients via e-health. E-ceremonies are delivering graduations, weddings, and birthday events.

Communications, software, biotech, and e-commerce have been among the best performers. On the other hand, non-tech sectors such as airlines, cruise lines, casinos, and automotive, have receded. And in low-growth or stagnant sectors, the tech-enabled disruptors have grown the fastest. For example, in entertainment, witness the growth of streaming media at the expense of cable services. Or in education, witness the growth of e-learning enabled enterprises.

“Dow Jones Industrial Average Compared to NASDAQ Composite” (Data from Yahoo Finance, as of 9.06.20)

Pandemic as Change Agent

Why have Zoom, Twilio, Shopify, and Atlassian become runaway successes? The COVID crisis has boosted them more than most other companies: Zoom for everyone to run businesses, schools, events; Twilio for cloud communications; Shopify to find online growth while controlling one’s destiny compared to selling on Amazon; Atlassian to manage projects; and several others.

As humbling as it is to acknowledge this fact, while venture capital and venture firms are recognized as drivers of digital transformation, the pandemic has been a much bigger factor in driving growth. At Great North Labs we terminated our office lease and deployed reporting methods for our portfolio companies that enable electronic data transfer and analysis. We conducted our own 2020 annual meeting as an e-meeting. In lieu of serving hors d’ouvres at a live event, we used a local startup to send Giftbombs. As much as we have pondered these ideas in times past, the pandemic is motivating this digital transformation.

Where to Invest?

So, in this mix, where should we invest?

- Money market funds? They will not keep up with inflation.

- Real estate? Only if you want a traditional rate of return.

- The stock market? Only if you invest in tech and tech-enabled businesses with strong balance sheets. And if you need easy liquidity.

- Venture capital? Maybe.

Venture capital has the potential of highest value creation of any asset class. All the big tech companies started as venture-funded startups. Imagine if you had invested a few dollars in them when they were young. The negatives of venture investments are that they are not liquid for several years. So, if you can invest and wait, this is a good option. Another key negative is that many investments fail. For this reason, investing as family and friends from a limited pool you have access to is riskier than from vetting across a large pipeline by a venture fund.

It is also true that innovative companies get started at the highest rate during downturns and discontinuities, such as the pandemic crisis we are in now. As a result, more than ever, the world is now teeming with start-ups building solutions to make the world better with high capital efficiency. And they are targeting every sector: healthtech with new drugs and vaccines; supply chains with secure ledgers; insuretech with more tailored insurance; fintech with better access to and management of personal or enterprise capital; foodtech for better food and access; mediatech for pervasive information and media access…you see the picture. Then there are startups enabling these companies: companies enabling training and placement of specialized workers; companies delivering customer service more effectively; companies providing remote accounting, legal, and marketing; and companies training and retraining workers for the future – in product development, customer service, accounting, marketing, demand generation, or anything else.

The world does not need more brick-and-mortar businesses sustained by PPP loans. They can reinforce or repair moats, but we will get better returns from supporting the young innovators. The world needs startups that build value in the post-pandemic world in capital efficient ways, and help the brick-and-mortar incumbents get a new lease on life.

The Decade Ahead

How long will this new wave of startups continue, and what is the period over which their value creation will deliver returns?

The impact of past pandemics – smallpox, yellow fever, bubonic plague – rippled through economies for decades, and caused permanent changes. Among other things, outcomes of past pandemics included industrial equipment for productivity increases to offset population losses, vaccines for health, social safety nets, and new fiscal and monetary policy. Many of these changes have now been part of our lives for decades and in some cases centuries.

In the current pandemic, we have already seen seismic shifts. Post-COVID, the seedlings of Silicon Valley are sprouting at an ever-faster rate in Middle America and many other locations worldwide. At Great North Labs, we believe venture investing and the creation of new enterprises will spawn a new productivity cycle that will permeate economies across the globe over the coming years and decades. In the widespread, tech-enabled economic recovery that we are already seeing, the current venture investment cycle which will seed new startups may well be among the more productive than its recent predecessors.

NOTE: THIS DOES NOT CONSTITUTE AN OFFER OR SOLICITATION WITH RESPECT TO GREAT NORTH FUND INTERESTS IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL.