Rob Weber //

Celebrating Two Years of Great North Ventures Fund II

It’s been two years since we announced our $41 Million Fund II back on May 23, 2022.

Let’s celebrate with a progress update on where our second fund is today:

- We’ve invested $12 Million into 19 startups

- Thematically, we are still focused on our three primary investment themes. Those three themes are i) Digital transformation through AI, ii) solving labor problems and iii) community driven applications.

- Here are some of our Fund II’s investments under each theme-

- We continue to rely on a network driven approach to identifying ambitious founders who are based in markets underserved by the broader venture capital market.

- Where are these underserved markets?

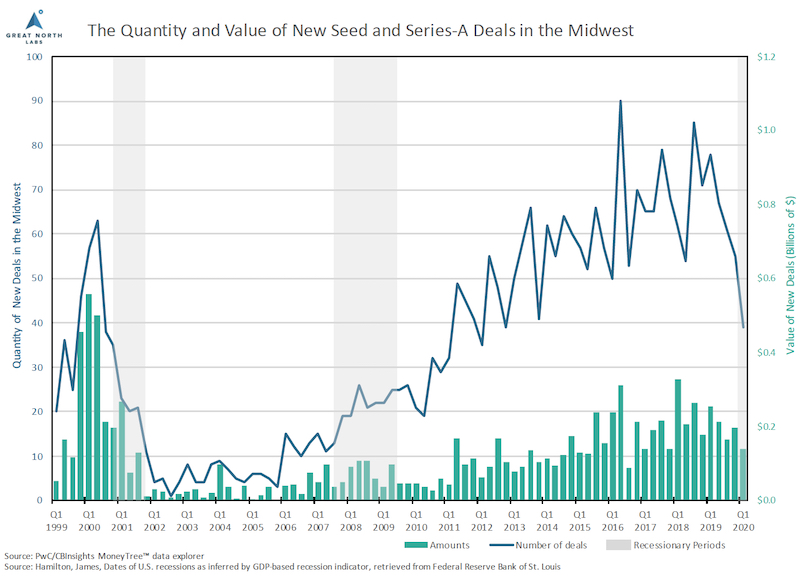

- The Midwest, especially in Minnesota where we are headquartered.

- LATAM. Similar to the Midwest, we are finding the LATAM venture capital market is a capital dessert. We have made our first two LATAM investments, Mangxo and OneCarNow.

- Where are these underserved markets?

- Team Update- All three of the General Partners are still with Great North Ventures, namely Ryan Weber, Pradip Madan and me. We also added two new Associates who are coming up on one year of full-time contributions, Joseph Daher and Grant Gibson.

- In terms of our future outlook for Great North Ventures Fund II-

- We have 60% of the capital committed still yet to be deployed, which is approximately $24.6M.

- We are planning to add another 7 to 10 new portfolio companies to our Fund II portfolio while also investing into select follow on rounds of breakout Fund II portfolio companies.

- The most active spaces we are spending time in are B2B SAAS and fintech.

- In terms of stage, we are looking for startups which have launched their initial product and are showing early signs of product-market fit. We have no minimum revenue threshold for the stage we invest, but rather use a more qualitative review to determine if signs of product-market fit may be present.

- We typically write initial checks are $250k to $1M into Seed stage companies with the potential to follow on in subsequent early-stage rounds.

I’d like to personally thank each of our fund’s investors who invested in our Fund II. Without your support, we would not be able to back these ambitious founders as they endeavor to build truly special companies.