Josef Siebert //

How the University of Minnesota is Embracing Startup Culture

The University of Minnesota is embracing startup culture across disciplines and producing results in the number of founders, tech talent, and startups. One of the top universities in the country with enrollment regularly over 50k, a system-wide endowment of nearly $4B, and over $1B spent annually on research and development, it’s incredibly important for the cultivation of early-stage tech startups in Minnesota and the Upper Midwest. Because of this alignment, Great North Labs engages with the U of M in several ways.

How the U of M is Engaging

John Stavig is a leader in the tech startup community. The managing director of the Gary S. Holmes Center for Entrepreneurship, Stavig teaches entrepreneurship courses and leads the Center. He helped launch one of the first student-run VC funds in the world, Atland Ventures, with David Russick.

Stavig has opened the doors to the Carlson School of Management for events and educational opportunities that benefit both students and startup community members. Great North Labs’s Ryan Weber has taught Lean Startup boot camps out of Carlson, at Stavig’s invitation, reaching ~50 students with our Startup School. Ryan has also guest lectured in the Applied Technology Entrepreneurship course on conducting market research and fundraising.

MN Cup is elevating the entire startup scene. MN Cup has become the largest statewide startup competition in the country. MN Cup takes no equity, is totally free, and distributes half a million dollars in seed funding to their startup participants. The exposure, funding, and recognition they receive is unparalleled in Minnesota. Some of the biggest startups to come out of the competition are:

- Sezzle- 2016 High Tech Division winner

- Stemonix- 2016 Grand Prize Winner

- Kipsu- 2015 Finalist

- 75F- 2014 Grand Prize Winner

- WhenIWork- 2013 High Tech Division Winner

- Foodsby- 2013 Semifinalist

Donors like the Carlson Family Foundation enable Director Jessica Berg to make MN Cup possible. The competition grows bigger every year through their support and efforts. Great North Labs’s Rob Weber judges every year in the High Tech division, and can attest to the increasing quality of startups. Great North has invested in two MN Cup alumni to date, Plyo (2018 Student Division Winner) and TeamGenius (2017 Semifinalist).

Atland Ventures provides students real VC experience. Atland is the first-of-its-kind, student-run venture fund, investing in companies that leverage disruptive tech. Originally founded in 2016 by four students, Atland has invested in a dozen companies, including two in the Great North Labs portfolio, Structural and Dispatch. Atland is an independent company, not a student organization, and students can actually see profits from their efforts if the fund succeeds. Their faculty support is from Stavig, David Russick, founder of Gopher Angels, and Raj Singh, Assistant Dean of Undergraduates at Carlson.

The limited partners include some of the most active local early-stage investors, including our partners Ryan and Rob Weber. Rob also serves as a mentor, and has recruited past Atland directors and managing partners to expand on their practical experience by interning at Great North Labs. The experience students gain at a working venture capital fund is a tremendous benefit in an industry that is notoriously hard to get in, and several have gone on to land jobs at startups and venture funds.

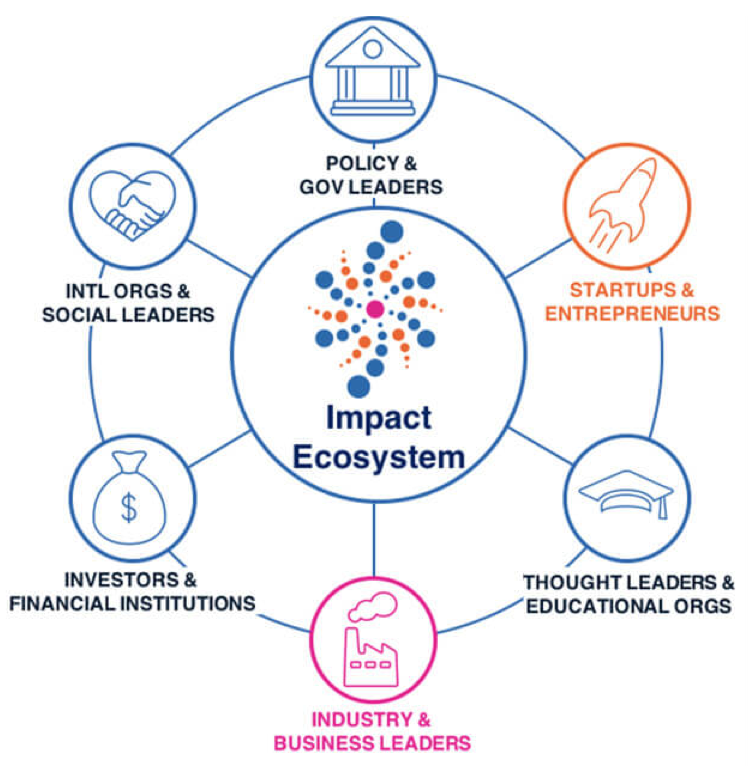

The U of M has a proliferation of startup support efforts across disciplines. Venture Builders, Grow North, MIN-Corps, WE at the Holmes Center; the Venture Center, MNBridge, and the Discovery Capital Program at University of Minnesota Technology Commercialization, are among the additional efforts to cultivate and support startups.

One example of the results of this multi-disciplinary collaboration is a startup we recently looked at called Grip Molecular Technologies. Grip is a cutting-edge startup using novel nanomaterials in an electronic biosensor to provide medical diagnostics. Not only are 2 different research scientists on the team from the U of M, but also a marketing executive.

Results by the Numbers

Since 2006, the U of M has launched over 165 startups. They have attracted over $1.15B in capital, and 7 have gone public since 2017. Investors can track U of M startups as they develop, through an online Startup Pipeline.

The U of M is ranked #18 for Global MBA programs in Entrepreneurship, with the largest statewide startup competition in the country, and 260 mentors providing guidance. Countless students have gone on to lead or work in startups.

In the Great North Labs portfolio, startups employ over 63 U of M alumni. That averages to nearly 2 U of M alumni for every startup we have invested in!

Why It Matters

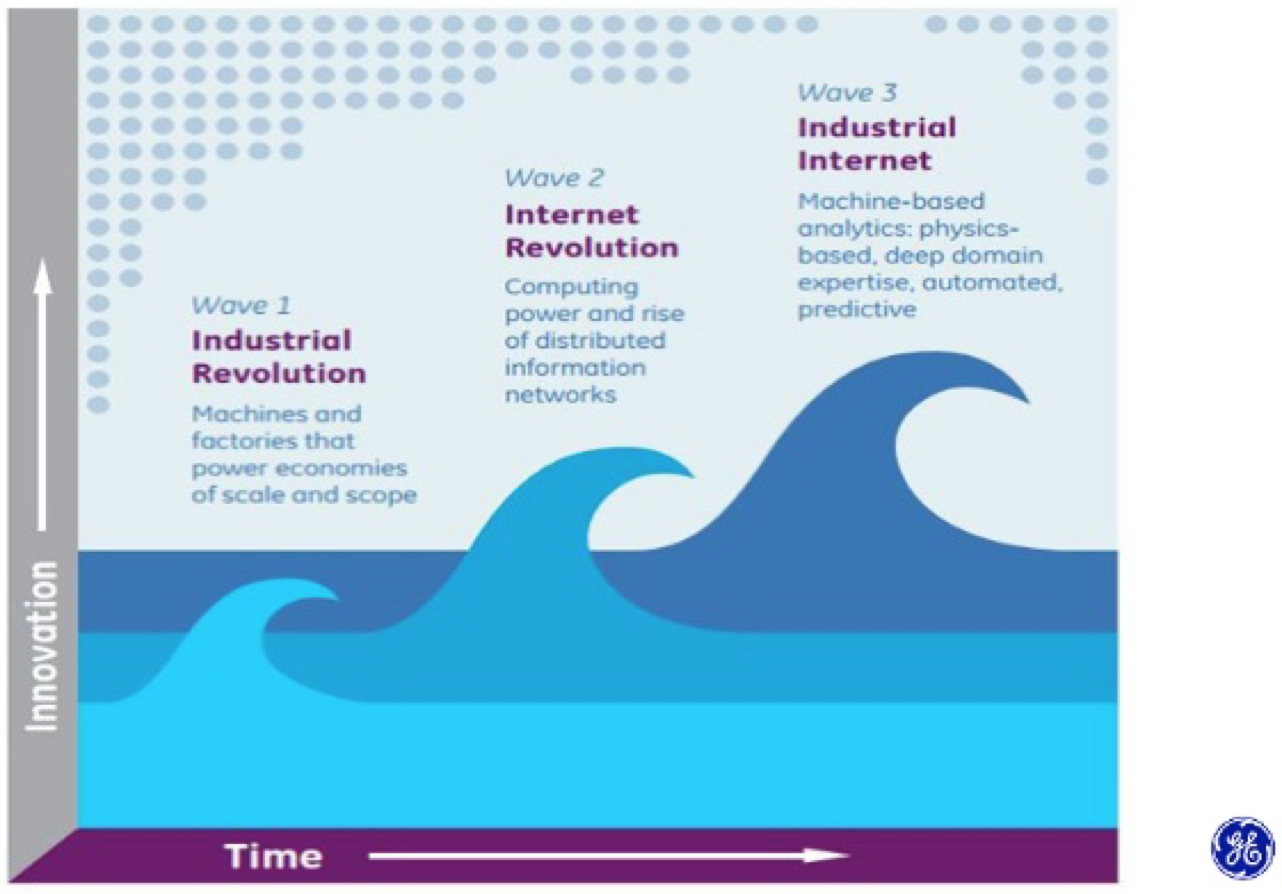

The University of Minnesota is embracing startup culture across disciplines, and is contributing to the growth and development of talent, capital, and support necessary to early-stage startups in the region. This enables digital transformation and innovation across sectors. We are aligned with this approach, and work with the U of M to realize economic value creation in Greater MN, Minnesota, and across the Upper Midwest.

While people and companies capture headlines with big funding rounds, IPOs, and acquisitions, much of the work the U of M is doing is out of the spotlight. The truth is that the university is plugged in and making a difference in the startup ecosystem.

We’ve seen it firsthand, working with the administrators, the organizations, the faculty, and the students. And with leaders like Stavig, Berg, Russick, and the Carlson Family, the impact is only going to grow.